Winter Dormancy

In many ways, the first quarter of 2017 reflected the past two years of the Bainbridge Island real estate market and the markets of most of the neighborhoods around us. Seasonably low inventories limit buyers’ choices early in every year. Meanwhile, inclement weather tends to dampen the enthusiasm of sellers getting homes ready as well as buyers who would rather stay in than venture out to look at properties. Finally, there’s a perception that the market doesn’t really “begin” until spring. These factors all conspire year after year to make the first quarter the quietest.

A Snapshot of Activity

Looking back to 2016, there were 72 residential transactions in the first quarter, compared to 129 in the second quarter, 156 in the third and even 117 in the fourth (also perceived as a slow quarter). So we were prepared for the “slow time” this year. We hoped for more inventory because we knew there was demand. As it turned out, in spite of the weather, we got a little bit of what we wanted. We had 83 residential home and condominium sales in the first quarter of 2017, up 15% from last year’s 72. It should not be a surprise that our active inventory was up 29% from last year when measured on February 2nd. In a sellers’ market, inventory is the fuel that pushes the machine (as opposed to buyers being the fuel in a market they control). But there’s a footnote to these numbers: the condominium market had 27 sales – the best first quarter we’ve had since 2007 – and condominium sales were up 68.8% over last year’s first quarter figures. If we set aside the increase in condominium sales, our first quarter sales were essentially flat.

Price Considerations

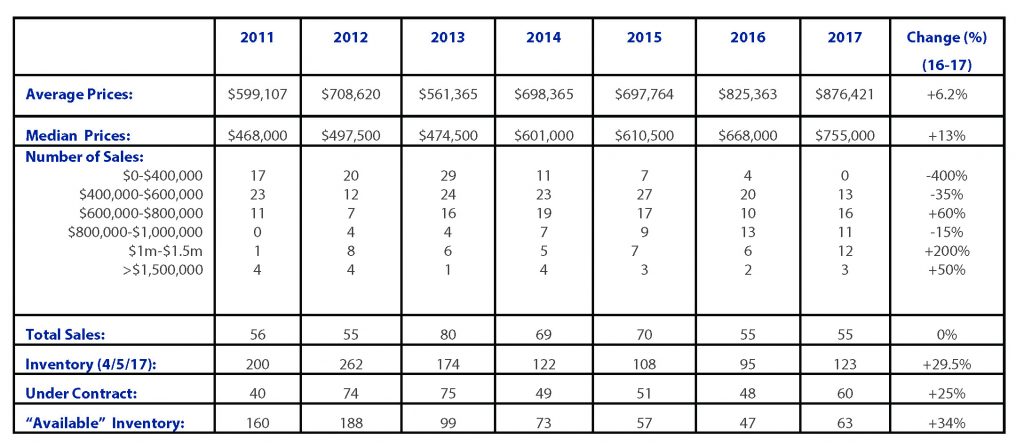

As home prices continue to rise, condominiums are becoming an important option for people who are being priced out of single family homes and those who are downsizing. In the first quarter, there were 13 homes sold for less than $600,000; there were 14 condominiums sold in the same price range. The median price of condominiums was $517,000 and of homes was $755,000. Condominiums represented 37.5% of the residences sold in the first quarter, compared to 22% last year. This is also not lost on developers, which is evident when you look at the new construction both underway and in the pipeline, where condominium products are strongly represented.

Perception versus Reality

The media has painted a pretty rosy picture of our market for sellers: just put up a for-sale sign, set any price you want and wait for multiple offers to roll in! In reality, while a strong market can make it easier to sell a home, there are certain goals that need to be in a seller’s mind regardless of the market.

- The first is to sell the home within an acceptable time frame. On the following chart, you’ll see the “active” inventory is higher than it’s been since 2013. Also, even if you have an interested buyer, it doesn’t mean that buyer will end up purchasing the home. This quarter, there were 16 “failed sales” or homes that fell out of contract, down from 37 last year. Sales fail for all sorts of reasons: buyer’s remorse, which can come from price; realization of property condition; and reality checks are the most common. Getting the home sold in an acceptable timeframe is important to most sellers. In this past quarter, the average days on market was 71. Some homes sell right away, but they are usually the exception.

- The second goal is to maximize the net yield to the seller. Condition, disclosures and presentation all affect buyer perception and price consideration. Buyers are smarter than ever and they are conducting their own market research with their Realtors. Buyers need inventory to choose from. They will not buy home at any price, and their price ceilings are dictated by their perception of value. There are some multiple offers, but only 29% of homes sold in the first quarter went for over asking price (which may be fewer than some people would think) and the percentage of the overage was a scant 3%. The boom of 2007 was not that long ago and most buyers (and their agents) clearly remember the risks of overpaying.

Closing Thoughts

We are in a sellers’ market with multiple offers and prices are rising but our market is smaller, less active and has a smaller buyer pool than Seattle. To gain maximum benefit from this market, sellers should keep this in mind. It’s important to consider the buyer’s perspective, where there is another labyrinth to negotiate. About 40% of Bainbridge sellers end up on the other side of the table when they later become Bainbridge buyers, so they eventually experience the flip side of our market. Working with an experienced professional will help you achieve the best result and understand the many nuances, of the Bainbridge real estate market. So let’s dive together into this busy season. It’s going to be an exciting ride.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link